The Black Lung Disability Trust Fund has been around for about forty years, providing benefits to miners and, in some cases, to their surviving dependents to help them recover from the increasingly prevalent and powerful disease pneumoconiosis. “Black Lung Disease” was coined as a term because of the way the dust buildup inside the lungs can make them appear black. The Disability Fund has been in financial jeopardy for years, with expenditures consistently exceeding revenue, but the situation is about to become worse in 2019 when the excise tax that resources the Fund is set to decrease by 55% despite the fact that more than 25,000 people rely on its benefits as of 2017. Recently the cases of Black Lund have been increasing.

Funding for the Fund comes from the Black Lung Benefits Revenue Act of 1977, which assesses a tax on operators per ton of coal mined. Not all miners are eligible for benefits: some operators cover expenses related to the disease, but others do not, and some operators are no longer is existence, leaving their former miners with bills to pay on their own. This is where the Fund kicks in. According to a report by the Government Accountability Office (GAO),”The current tax rates are $1.10 per ton of underground-mined coal and $0.55 per ton of surface-mined coal, up to 4.4 percent of the sales price. Therefore, if a ton of underground-mined coal is sold for less than $25, than the tax paid would be less than $1.10. For instance, if a ton of underground-mined coal sold for $20, than it would be taxed at 4.4 percent of the sales price, or $0.88” In some years, though, this income has covered less than 40% of the cost of the program, forcing it to borrow money from other funds, creating debt and resulting interest payments that take up even bigger chunks of its budget.

The same report by the GAO outlines various scenarios that would help maintain the Fund, ensuring that eligible miners who need its support are able to receive benefits. The proposal the Center for Coalfield Justice and our allies through the Alliance for Appalachia would support is an increase in the excise tax levied on mined coal by 25%. This increase would add $0.27 to the tax on underground-mined coal – literally spare change.

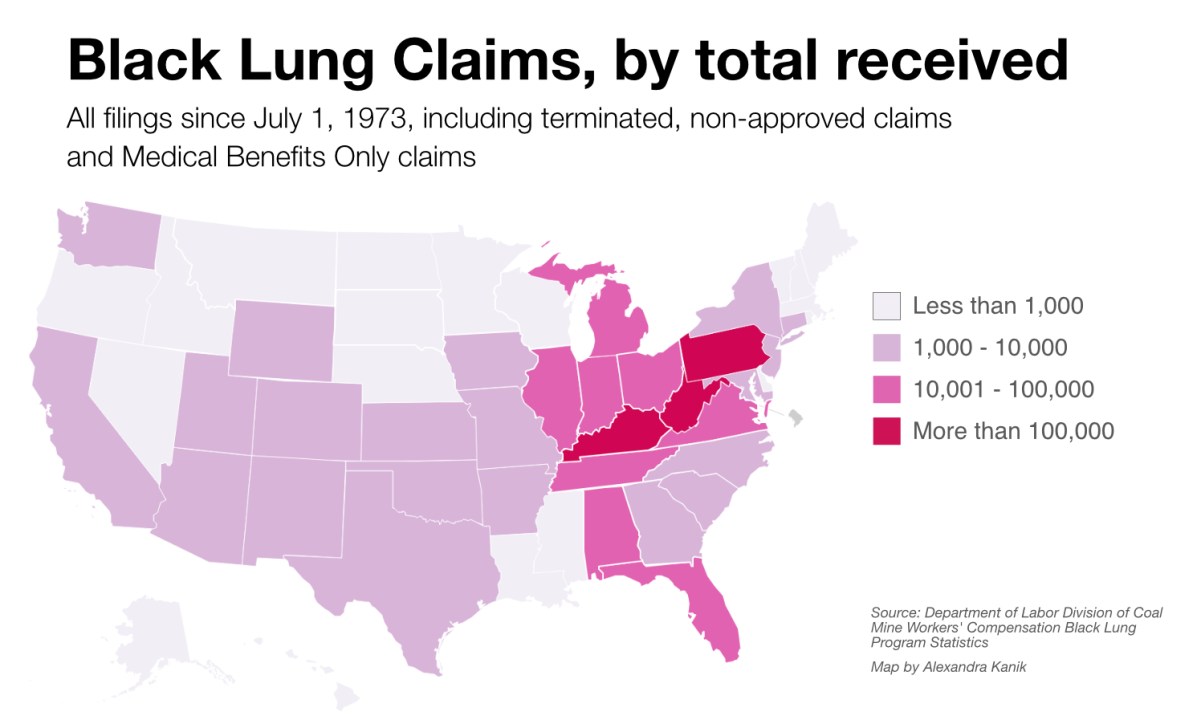

The Alliance for Appalachia is planning a trip to Washington DC in September to speak with senators and representatives from Kentucky to Pennsylvania, raising awareness and advocating for policies that would keep the Fund intact.

For more information on the Black Lung Disability Trust Fund or on the upcoming advocacy trip, please contact Sarah Martik, our Campaign Coordinator, at smartik@centerforcoalfieldjustice.org or 724-229-3550x.1.