Over the past two years, the world has been told that the explosion in data-center construction is inevitable — even essential — to power the “AI revolution.” Tech executives, investors, and policymakers alike have repeated this story until it sounds like common sense: we need more data centers to keep up with progress.

But this sense of urgency isn’t organic. It’s not being driven by public demand or by genuine technological necessity. It’s being manufactured by the very companies that stand to profit the most.

What we’re witnessing is not an objective response to an unavoidable technological shift, but a carefully engineered narrative by the AI-industrial complex in which the same handful of corporations build, fund, supply and hype each other’s expansion.

The Myth of Necessity

The prevailing narrative goes something like this: AI is the future, and data centers are the engines of that future. Without them, innovation will stall, economies will falter, and nations will lose their competitive edge.

Yet few people stop to ask a fundamental question – who decided this was true?

The urgency around data-center construction is largely self-generated. Big Tech firms invest in AI models that require vast computing resources. They then claim a shortage of such capacity to justify further infrastructure spending. Chipmakers and cloud providers see the rising demand, which conveniently comes from one another, and respond with more production, more hype, and higher valuations.

This narrative also overlooks the likelihood of rapid technological progress toward far greater computational and energy efficiency, meaning that locking in energy-intensive facilities and long-term contracts could create infrastructure inertia that disincentivizes efficiency innovation while amplifying self-reinforcing scarcity claims and geopolitical hype. The result is a self-reinforcing cycle of mutual justification and self-fulfilling scarcity. In this closed circuit, the appearance of necessity becomes indistinguishable from actual need.

The Circular Economy of Influence

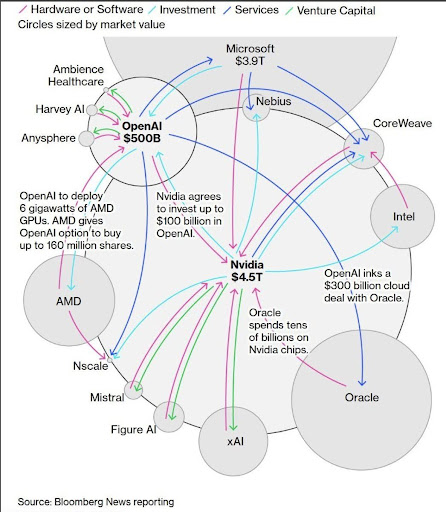

At the heart of this loop lies a web of corporate interdependence. Leading hardware manufacturers, cloud service providers, and hyperscale operators feed into each other’s growth. For example, the same firms producing high-end GPUs for AI also lease those machines through their own cloud services. The infrastructure they then build justifies even more demand for hardware and power, which in turn drives higher valuations in the stock market.

The hype surrounding AI and data centers is not just technological; it’s also financial. Massive investment is being poured into infrastructure whose returns are often opaque. The very companies that stake claims on future AI dominance are the same ones building capacity in anticipation of demand that they themselves generate.

This “circularity” of investment and consumption creates a feedback loop where industry and partners fund one another ‘s growth, inflate expectations for compute demand, and prop up valuations and narratives that may outpace actual sustainable usage and technological needs. These flows of money and power reinforce the narrative: build now, build bigger or be left behind.

The danger is that this loop might mask inefficiencies, discourage energy innovation and compute efficiency, and lock in expensive, energy-intensive infrastructure and grid development that becomes less necessary as hardware and model efficiency improve and inflated assets disappear; Much like inflated trading values distort price signals in markets without real economic activity.

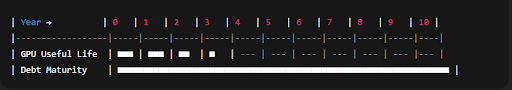

The Debt Time Bomb

Right now, the AI and data-center buildout is being driven heavily by debt rather than proven profits, creating a fragile financial foundation. Companies, including hyperscalers and specialized data-center operators, have raised huge amounts of borrowed capital to fund infrastructure that may not generate enough revenue to cover interest or repay loans, meaning a misstep in demand or a shift in technology could leave lenders and shareholders facing losses. The values of certain equipment, such as GPUs and servers, depreciate rapidly to the extent that the debt lasts longer than the equipment’s lifetime.

The financing structures themselves can also obscure risk and magnify potential pain if expectations aren’t met. Off-balance-sheet deals, securitizations, circular arrangements, and complex private credit structures make it harder for investors and regulators to understand how exposed markets really are — a situation that some commentators have likened to the conditions preceding the 2008 housing crisis. Meanwhile, the possibility of overbuilding (excessive capacity relative to actual demand) and the threat of lower profitability or slower AI revenue growth mean valuations could sharply correct, leaving highly leveraged companies vulnerable. Recent sell-offs in AI stock prices and rising credit risk indicators reflect growing unease about whether today’s optimism is outpacing economic reality.

Real-World Data You Should Know

- In the U.S., data-center grid-power demand is projected to rise 22 % by end of 2025, and nearly three times current levels by 2030 (to ~134 GW demand). (S&P Global)

- Capital deployment in U.S. data-center construction reached US $31.5 billion in 2024, with the development pipeline hitting nearly 50 million square feet, double the volume from five years ago. (Data Center Dynamics)

These figures show not just growth, but rapid acceleration. They also frame a reality where infrastructure is being built at breakneck speed, often ahead of scrutiny or analysis.

The Real-World Costs of an Engineered Boom

While this circular economy enriches a few, its externalities fall on everyone else. Data centers:

- Consume vast quantities of energy and water, often in regions already struggling with limited resources. For example, U.S. data centers consumed roughly 17 billion gallons of water in 2023. (Pew Research Center)

- Generate heat, e-waste and require land that often displaces agricultural or ecological uses.

- Frequently secure favorable tax deals or utility rates (Like in PA, where data centers don’t pay sales tax), shifting costs onto residents and public infrastructure maintenance.

- Divert investment from critical public sectors (affordable housing, education, health) into infrastructure whose long-term return is uncertain.

This is not sustainable development; it is digital extractivism.

Reclaiming the Narrative

The public debate around AI and infrastructure has been dominated by corporate messaging: we must build more, faster, or risk falling behind. But a healthy society must ask harder questions. What if the pace of construction is unsustainable? What if the benefits are overstated? What if slowing down investing in efficiency, sustainability, and transparency is actually the smarter path?

The myth of urgency serves Big Tech’s balance sheets, not the public interest. We should recognize it for what it is: a marketing campaign disguised as destiny.

Ultimately, much of the urgency and investment behind AI and massive data center build outs is driven not by clear scientific consensus on the feasibility or definition of Artificial General Intelligence (AGI)- a concept still deeply contested and often speculative- but by a narrative that benefits powerful tech actors and government backers, turning a trillion dollar financial gamble that could mirror past tech bubbles when expected returns don’t materialize. At the same time, this push is intertwined with real economic and cultural harm: generative AI systems are trained on massive swaths of human creativity work without consent or compensation, producing outputs that compete with and undercut human creators in the marketplace, threatening jobs, livelihoods and the value of human creativity all the while allowing billionaires to fire employees on the guise of efficiency and the detriment of the working class.

True innovation doesn’t come from endless consumption; it comes from wisdom, restraint, and the courage to question who’s telling the story of progress.