Here is a simple breakdown of what is going on:

TIMELINE

In December 2019, the novel coronavirus (Covid -19) was first detected in Wuhan, Hubei Province, Peoples Republic of China.

On January 31, 2020, in response to Covid-19, the Secretary of Health and Human Services (HHS) declared a public health emergency with the authority of the Public Health Service Act.

March 11, 2020, the World Health Organization (WHO) announced that the Covid-19 outbreak is a pandemic. A pandemic refers to an epidemic that has spread over several countries or continents, usually affecting a large number of people. A pandemic is usually worse than an epidemic. An epidemic is an outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population.

On March 13, 2020, President Trump declared the Covid-19 outbreak a national emergency, relating this declaration back to March 1, 2020.

Since then, our local government here in Pennsylvania has made a series of announcements that have essentially shut down all non-essential business and require many of us to follow a “stay at home” order. This order affects the entire state and extends through April 30.

WHAT HAS HAPPENED DURING THIS TIME?

In the first week of March, our federal government has taken several steps to help slow the spread of Covid-19 and provide financial support to those in need. On March 6, an emergency spending package was passed to help with the increased medical needs and cost in the nation. This package totaled $8 billion, allocates funds to the Department of Health and Human Services, Center for Disease Control and Prevention, and medical supplies to hospitals.

Next, on March 18, our elected officials signed the Families First Coronavirus Response Act. This act ensured that those who needed testing for the Covid-19 virus would receive it for free including no deductible or copayments. It also increased federal payments to Medicaid for states of 6.2%, provided an additional $60 million to the Department of Veterans Affairs for testing veterans, and gave $64 million to the Indian Health Service for testing members of Native American Tribes.

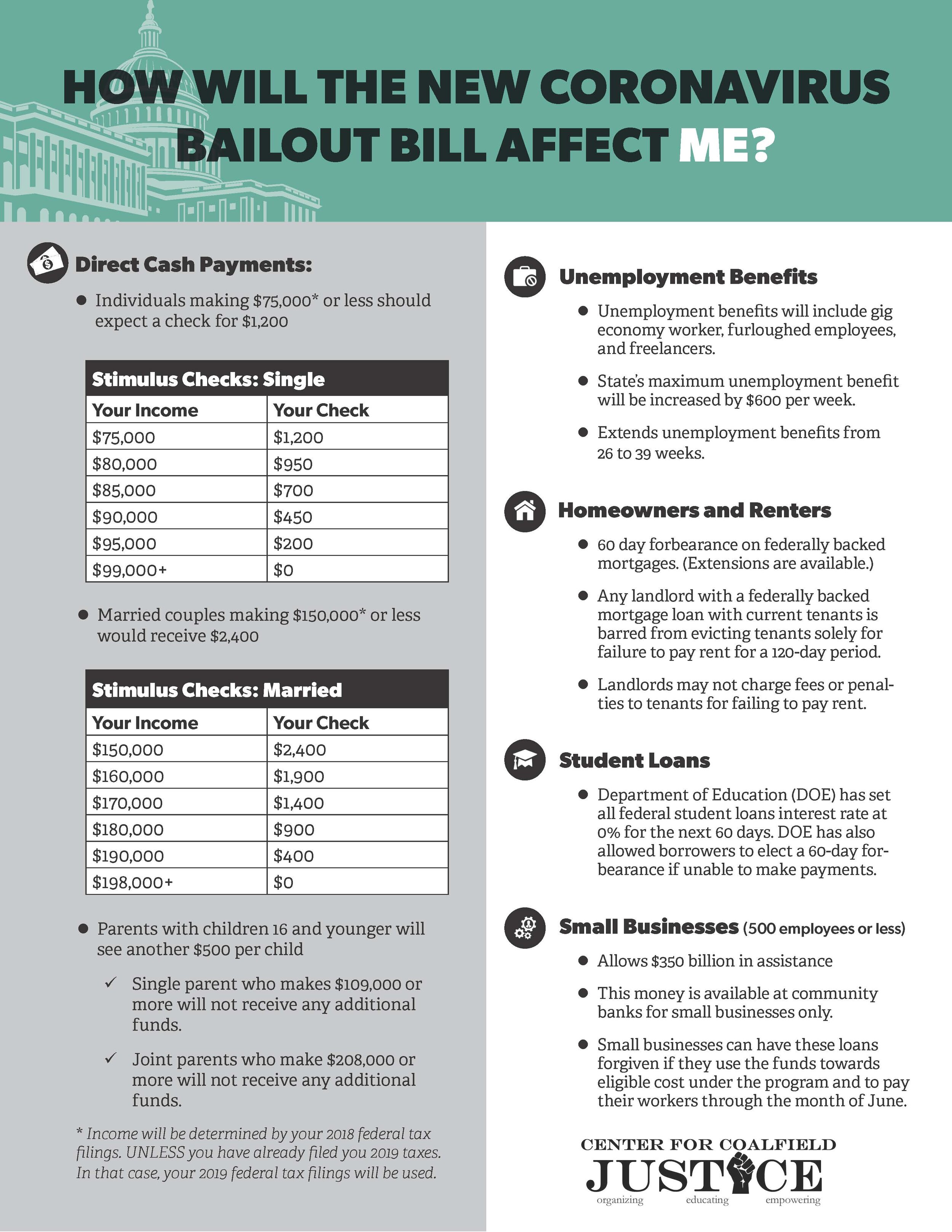

However helpful these packages have been, they pale in comparison to the $2.2 trillion package signed into law on March 27, 2020. Here is a concise breakdown of how this stimulus package will affect you and your neighbors.

HOW THE STIMULUS BILL WILL AFFECT YOU

Part of this bill is a stimulus provision intended to help Americans and small business owners navigate any economic distress. But not everyone gets a check. Checks will be paid out based on the reported income from your 2019 federal tax return. If you have not filed your 2019 taxes, it will be based on your 2018 return. If you have not filed federal taxes in 2018 or 2019 then you do not qualify for any payment under this bill.

DIRECT CASH PAYMENTS WITH NO PHASE-IN-PROVISIONS

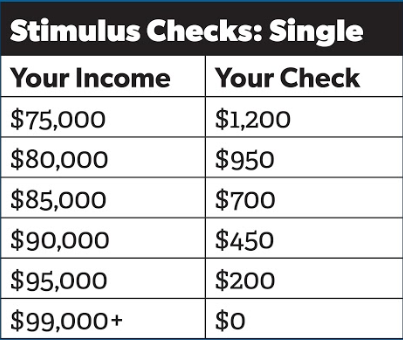

Individuals making $75,000 or less should expect a check for $1,200. The payments payout phases out starting at $75,000 at a 5% per dollar of qualified income, or $50 per $1,000 earned.

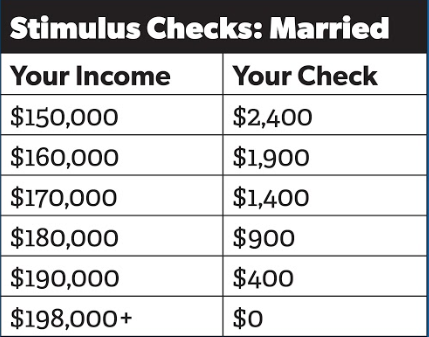

Married couples making $150,000 or less would receive $2,400. The payments payout phases out starting at $150,000 at a 5% per dollar of qualified income, or $50 per $1,000 earned.

Parents with children 16 and younger will receive another $500 per child. A single parent who makes $109,000 or more will not receive any additional funds. Joint parents who make $208,000 or more will not receive any additional funds. The payout is not considered as taxable income; thus, it is not going to be taxed on your 2020 income.

If the IRS already has your banking information, then you will receive a direct deposit of these funds. Otherwise, citizens should expect a check in the mail. The timing of payments is unclear, most likely not until May, possibly even June.

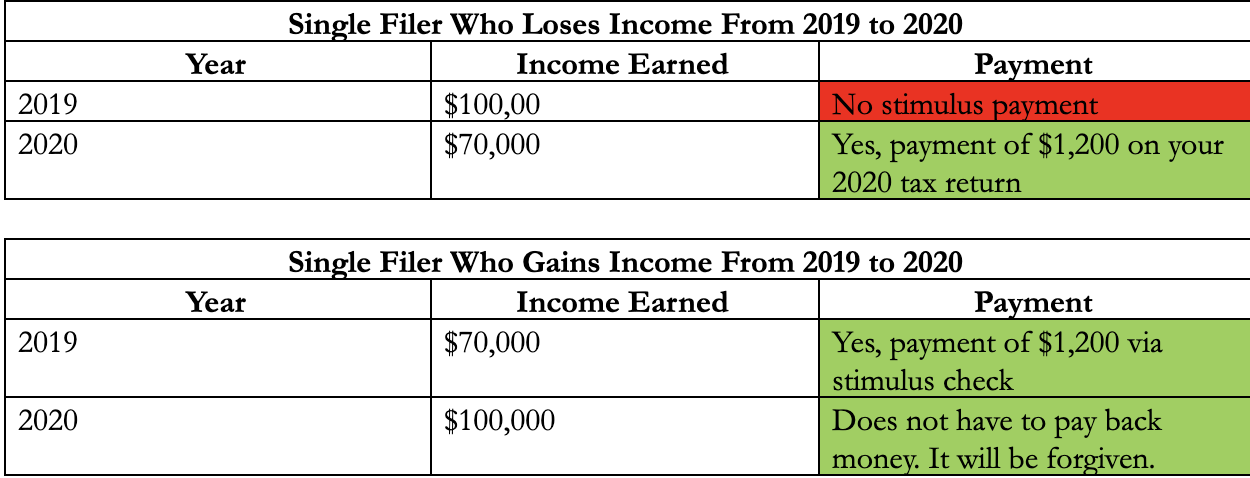

INFORMATION ON THOSE WHO MADE MORE THAN THE THRESHOLD LAST YEAR, BUT WILL MAKE LESS THIS YEAR

Because the federal government is using your past reported income to pay out the stimulus checks, it will not be helpful to those of us who will now earn less due to this economic crisis. According to the Tax Foundation, those who do not qualify for a payout based on their 2019 earned income but will qualify based on their 2020 earned income will see an appropriate payout on their 2020 tax return. If you do qualify for a payout based on your 2019 tax return but make more than the phase-out amount in 2020, that stimulus check will be forgiven, and you do not have to pay it back.

For example:

STUDENT LOAN PAYMENTS MAY BE PAUSED

Under this bill, close to 35 million Americans who currently hold federal student loans may not have to make their monthly payments until September. But they must file for a forbearance to qualify.

The Department of Education (DOE) has announced that borrowers of federal student loans may receive a 60-day forbearance and their interest rate will automatically be changed to 0% for at least 60 days. According to Fed Loan Servicing, a major holder of federal student loans, the DOE could extend the time on this 0% interest rate even further. This 0% interest rate will apply to all federal loans in any status automatically. Additionally, those borrowers who previously were in default will not see their finances seized. Importantly, this six-month period will still count toward those enrolled in loan forgiveness for borrowers in the Public Service Loan Forgiveness program as long as they continue to make payments. It is recommended to log into your student loan account and note your current balance to confirm that interest has stopped accruing.

Student loan payments are still due during this time. However, borrowers are able to request an emergency forbearance to postpone payments for at least 60 days if necessary. These changes only affect federally held loans and are not guaranteed by private lenders.

UNEMPLOYMENT BENEFITS

Unemployment benefits now extend to cover gig economy workers*, furloughed employees**, and freelancers. Additionally, the bill increases the state’s maximum unemployment benefit by $600 per week. In Pennsylvania, a person’s weekly benefit amount will be about 50% of their average weekly wages, subject to a weekly maximum of $573. Typically, benefits are available for up to 26 weeks. Under this bill, unemployment benefits will be available for 39 weeks. For more on how much would you receive under this, please visit the weekly benefit rate webpage.

INFORMATION ABOUT RETIREES

For retirees, the income considered when determining your eligibility depends on the last tax return you filed. If you are on Social Security but didn’t file a tax return in either 2018 or 2019, your eligibility will be based on your annual Social Security benefits statement. (See the charts above for payout amount.) However, if you haven’t yet filed a tax return for 2019, but your income in 2019 was less than it was in 2018 and doing so would put you below an income threshold to receive a payout, you may want to file taxes now. Lastly, if you are on Social Security and make income from another source, this combined income is what is used to determine your eligibility. Withdrawals from retirement savings plans, pensions, part-time work, small business earnings, or rental income are considered income and could put you over the threshold of receiving a stimulus check.

There are other benefits built into this bill that could financially help retirees and savers. First, under this bill people 59.5 and under are able to withdraw funds from their traditional 401(k), 403(b) and IRAs up to $100,000 without the typical 10% tax penalty. However, the bill provides two provisions to this, one being that the amount removed must be paid back over a three-year period. If not repaid, the borrower would pay income taxes on the amount withdrawn. The second allows for a loan that would be repaid over a prolonged schedule.

Second, the bill does not require minimum distributions. Usually, those who are 70.5 and older must withdraw a certain amount from their traditional retirement accounts. This is helpful because the amount one must remove from the account is based on the value of the account at the end of the prior year. The stock market is the factor that determines the value of the account. And as many of us know, the market has been in fluctuation and that has caused the value of retirement accounts to drop considerably in contrast to last December.

HOMEOWNERS AND RENTERS

The bill states that anyone who is experiencing financial hardship from this epidemic will be given a forbearance on a federally backed mortgage loan of up to 60 days. Borrowers can extend this up to 30 days no more than four times. It also protects homeowners from fees, penalties, or additional interest charges as a result of delayed payments.

Any landlord with a federally backed mortgage loan with current tenants is barred from evicting tenants solely for failure to pay rent for a 120-day period. Additionally, landlords may not charge fees or penalties to tenants for failing to pay rent.

UNDOCUMENTED RESIDENTS

This bill explicitly excludes those without Social Security numbers from obtaining the payout. The bill also disqualifies individuals who would otherwise be eligible but jointly filed their taxes with a family member who doesn’t have a social security number. Additionally, the four-month extension of unemployment insurance will also not apply to any undocumented immigrants, who are not eligible for the benefit. A technical loophole that prevents many lawfully present immigrants, such as those with DACA or Temporary Protected Status, from accessing federal Medicaid was also not resolved in the bill.

BUSINESSES

Small businesses also will see a heavy lift under this bill. What is being called a “Paycheck Protection Loan” will allow small businesses, 500 workers or less, access to low-interest loans to cover up to two-and-a-half months of payroll expenses, salaries, sick leave, and other compensation benefits. With a maximum of $10 million, these loan rates cannot exceed 4%. One of the eligibility requirements of these businesses is that they show a “good faith certification” that the loan money will go toward retaining workers, preserving payroll, or paying necessary expenses such as rent.

Most importantly, small businesses are able to have these loans forgiven if they use the funds towards the eligible cost and pay their workers through June. The forgiven amount is scaled back if the employer lays off workers or reduces their employees’ pay.

Large businesses, those of 501+ employees, will have access to an allocated $500 billion to help with financial stress. Some of this has been divided up specifically. $500 billion was allocated to airlines and $17 billion to national security firms. The remaining amount will go to states, local governments, and to distressed businesses.

REAL ID DEADLINE

The deadline to get a REAL ID has been extended until at least September 2021.

WHAT ABOUT OUR ELECTED OFFICIALS?

This bill prohibits federally elected officials and their immediate relatives from obtaining any funds from this program. Any business owned or partly owned by the President, Vice President, the head of an Executive department, or a Member of Congress is barred from this program. Additionally, any spouse, child, son or daughter-in-law is also barred from the program.

*A gig is a temporary job. The employee often works on a specific project for a company, either as an independent contractor or a freelancer. … The benefits of a gig job are that it allows you to work on multiple projects for multiple companies at once (generally). You can often work from home and have flexible hours.

**A furlough is “a temporary layoff from work.” People who get furloughed usually get to return to their job after a furlough. In general, people are not paid during furloughs but they do keep employment benefits, such as health insurance