The word “politician” can leave a bitter taste in some people’s mouths. What we are experiencing in Pennsylvania these last couple of weeks only perpetuates this reaction. If any of you follow environmental blogs or receive updates from those who cover the environmental political field in this state, then you have read or heard about House Bill (“HB”) 1100. HB 1100 has been forced into the spotlight for many people in Pennsylvania because of its destructive nature to our health and to the state’s economy. In short, HB 1100 creates a massive tax break to help the petrochemical industry continue to develop in the Commonwealth. In doing so, HB 1100 would deny communities funding that could be invested in infrastructure, schools, and aid to those who are struggling due to the financial fallout from COVID-19.

Fortunately, Governor Wolf had the common sense to veto HB 1100 after it passed the House and the Senate with overwhelming support.

The Governor said in his March 27, 2020 press release: “[r]ather than enacting this bill (HB 1100), which gives a significant tax credit for energy and fertilizer manufacturing projects, we need to work together…to promote job creation and to enact financial stimulus packages for the benefit of Pennsylvanians who are hurting as they struggle with the substantial economic fallout of COVID-19.”

He went on to say that he would only support the kind of corporate handout such as the one offered in HB 1100 after there was a proper analysis of the proposed projects and promises that workers will be paid appropriate wages. At the time of this posting, such an analysis has not yet been conducted. Therefore, it leads many to believe that our Governor would not support HB 1100 or any other bill that resembles it until an analysis is conducted and we receive reassurance that the money will benefit workers.

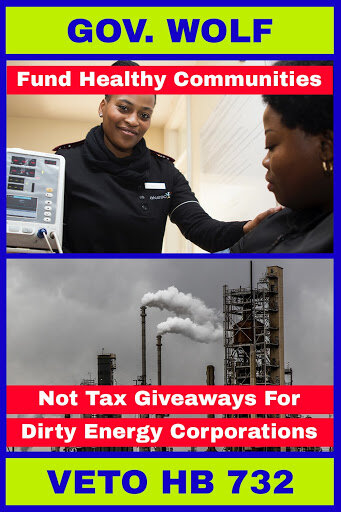

However, there is a bill out there that resembles HB 1100. In fact, there is a bill that is currently sitting on our Governor’s desk that looks very similar to HB 1100. That bill is HB 732. HB 732 was amended last week (July 13, 2020) to include several provisions that were originally drafted in HB 1100. For example, HB 732 now provides tax credits to the petrochemical industry for the next 26 years that add up to over $690 million in lost tax revenue. This corporate handout is available only to facilities that manufacture petrochemicals and fertilizers using fracked gas.

HB 732 was sent to the Governor on July 15th. The Governor now has three options: veto it, sign it, or let it become law by non-action after 10 days. Based on his previous veto of HB 1100 and his explanation for why he vetoed that bill, HB 732 seems like an obvious veto on its face. However, the Governor has had HB 732 on his desk for over a week.

This begs the question: what deals have been struck in Harrisburg?

While transparency in Harrisburg is lacking, it is rumored that Governor Wolf agreed with members of the General Assembly that he would sign HB 732 into law as long as there was little to no push back for allowing the Regional Greenhouse Gas Initiative (RGGI) to pass. In the fall of 2019, the Governor signed an executive order which started the process for the Department of Environmental Protection to draft a RGGI rule. The goal of RGGI is to lower carbon emissions from fossil fuel power plants. But in retaliation to this order, the House issued and overwhelmingly passed HB 2025. HB 2025 prevents the state from joining RGGI through executive orders. Yet, even if it is true that Governor Wolf made a deal with the General Assembly behind closed doors, and HB 2025 does not pass, the emission levels from the increased development due to HB 732 would undermine the Governor’s goal under RGGI of reducing carbon emissions by 80% by 2050. For example, the Department of Environmental Protection has permitted Shell’s cracker plant in Beaver County to emit 2,248,293 tons of CO2 a year. It would take over 2.6 million acres of forest to absorb that much CO2. The cracker plant, which makes plastic, does not fall under RGGI as RGGI only regulates electricity generators. Thus, the taxpayers lose out on hundreds of millions of dollars, have their natural resources stripped from the land, and we are likely to see our air, water, and land polluted more than before. This is a lose, lose scenario. One must ask, does Governor Wolf really care about fixing the climate crisis, or just the optic of taking climate action?

Perhaps even more troubling is the number of our elected officials who voted in favor of HB 732, which again contains so many of the harmful provisions of HB 1100. They still voted for this bill after months of dedicated work put forth by dozens of environmental groups and hundreds if not thousands of individuals explaining to our elected officials the harm associated with HB 1100. The Governor previously recognized that the provisions in HB 1100 (now included in HB 732) did not benefit the Commonwealth. Both bills rob the blue-collar worker of tax dollars that should be used to build and repair streets, bridges, and community buildings. The bills rob our children and our state’s future by not providing the needed funding for our schools. Nonetheless, all but 38 Representatives of the House and nine Senators voted for HB 732.

The representatives that voted in favor of HB 732 have not provided a reason for why they believe the bill is the right choice for their constituency. Elected officials often proclaim that this is an “economics and jobs bill.” But this argument has some serious flaws. For example, the Shell Cracker plant in Beaver County, which received a $1.65 billion tax credit, will only result in a total of 600 full-time jobs. This equates to $2,750,000 per employee. Compare this to the $16,627 spent on each child in the Pennsylvania school system, and there seems to be a major disparity here. The proposed petrochemical facilities in Clinton County and Luzerne County are projecting 150 and 200 jobs respectively. There is no doubt that there would be a demand for jobs in construction. However, focusing on the development of cleaner, more sustainable energy and manufacturing could create the same demand in construction. In fact, this kind of development would create jobs in two sectors: green energy construction (which does include union jobs) and training in green energy installation and development. A report by the Analysis Group shows that several of the RGGI participants have created over 14,000 new jobs by investing in green energy. Not to mention that they also had a reduction in their CO2 emissions. Thus, by investing in other forms of energy, the state would see a greater benefit: more jobs in more sectors, lower utility bills, and less pollution. This looks like a win, win scenario.

No matter how far into this discussion we get, eventually someone brings up the name “Solyndra” that so many green energy advocates hate to hear. Solyndra is the solar company that brought promises of 3,000 construction jobs and as many as 1,000 full-time jobs once the facility opened. A company that was granted a $535 million Department of Energy loan guarantee under the American Recovery and Reinvestment Act of 2009. A company that also filed for bankruptcy in 2011. Those who are invested in the oil and gas industry love to rub this in the nose of the green advocate. And they are right, Solyndra filed for bankruptcy and it crashed and burned. It is the definition of complete failure. But those who bring up the name Solyndra never talk about Alpha Natural Resources, a company that owned two mines in southwestern Pennsylvania that filed for bankruptcy. Or Murray Energy, a major coal operator in southwest Pennsylvania who also filed for bankruptcy. Then there is Chesapeake Energy Corporation and Rex Energy, two oil and gas companies that operated in Pennsylvania that also filed for bankruptcy. Just in the first five months of this year, California’s Resource Corp, Bridgemark Corp, Southland Royalty Co., Dalf Energy, Sheridan Holding Co., Echo Energy Partners, Whiting Petroleum Corp., Sklar Exploration, Sable Permian Resources Holdings, SM Energy, Callon Petroleum, Fieldwood Energy, Gavilan Resources, Ultra Petroleum, Extraction Oil and Gas, and Centennial Resources Development have either filed for bankruptcy or are currently in default. The saddest part about all of this is that these companies leave a heavy and expensive burden for the taxpayer. When industry files for bankruptcy, the company walks away from their mess and leaves it for the state taxpayers to take over. They also abandon hundreds, if not thousands of employees without work and in some cases without severance pay or a pension that was promised to them. So, yes, Solyndra did fail, but it did not leave decades of pollution behind for the taxpayers to clean up. Pennsylvania needs to recognize that we are throwing good money at bad money, meaning that we are investing in a field that is experiencing a tremendous economic downturn.

What are the next steps? There is still time to contact Governor Wolf and demand that he stay true to his campaign message and his promise to not allow such a destructive bill to pass. Besides sending a letter, you can also call 717-787-2500 to demand that he veto HB 732. Sadly, the General Assembly has already voted on this, but that does not mean you are not able to reach out and demand a viable answer as to why giving a handout to the petrochemical industry is more important than our state’s economy and our health. We deserve transparency and the ability to have an open dialogue about why some bills should pass and why others should not. Lastly, we deserve to know why an industry that has proven to cause irreversible damage to both health and the environment was handed a blank check while others are struggling to make ends meet. Our state deserves better, our families deserve better, we deserve better.